apra super fund performance

Being a trustee of an APRA-regulated super fund and managing and spending billions of dollars of members money is a privilege not a right Ms Cole said in a statement. Most people can choose which super fund theyd like their super contributions paid into.

Fund Performance Smsfs Vs Apra Super Funds

APRA fails its super performance test.

. Internal management in focus AustralianSuper which oversees more than 244bn manages about 44 per cent of those assets in house. One of the most challenging problems plaguing superannuation choice is how to evaluate historical performance outcomes against a funds stated objectives which has been cast into relief by the regulators inaugural return test for 80 MySuper products. Our Balanced Super option was the second-best in Australia. Do lower fees mean better net returns.

The SFN is issued to trustee of a superfund but is used for identify the superfund entity not the trustee. SMSFs vs APRA super funds. Best performing super funds. The implementation of the Member Outcomes obligations and Design and Distribution Obligations administered by APRA and ASIC respectively saw the agencies work together to ensure trustees understood the interaction between the two sets of obligations.

Super funds of the year awards. One million Australians are currently in a super fund that failed the tax offices MySuper fund performance test. Learn more about super fees in the following SuperGuide articles. Being a trustee of an APRA-regulated super fund and managing - and spending - billions of dollars of members money is.

The action taken by APRA against AMP Super is cited as an example of their collaborative approach. APRA will extend its performance measure applied to My Super products in August to choice products from next July. Super fees and returns calculator. You can go with your existing fund your employers fund or choose a different fund.

Weve found the best-performing super funds the best industry super funds the best ethical super fund and the best super fund for low fees updated for 2021. Under that measure members of underperforming funds returning 05 per cent or. APRAs superannuation enforcer Margaret Cole slammed the funds misuse of members money. If youve received a letter from your super fund telling you it has underperformed dont ignore it.

APRA has found that 60 of investment options offered by choice super products failed to meet the regulators benchmarks. While we cant predict future performance based on the past our funds performance proves ethical investing is good for returns. SMSF funds are not regulated by APRA theyre regulated by the ATO therefore theyre not issued with an SFN. This could cost you as much as 230000 at retirement according to research by Industry Super Australia as even small changes in investment returns.

Learn more about the best performing super funds in the following SuperGuide articles. The Australian Prudential Regulation Authority APRA has today released the results from the inaugural MySuper Product Performance Test introduced as part of the Governments Your Future Your Super reforms. See how we scored in APRAs MySuper heatmap. What to look for in a super fund.

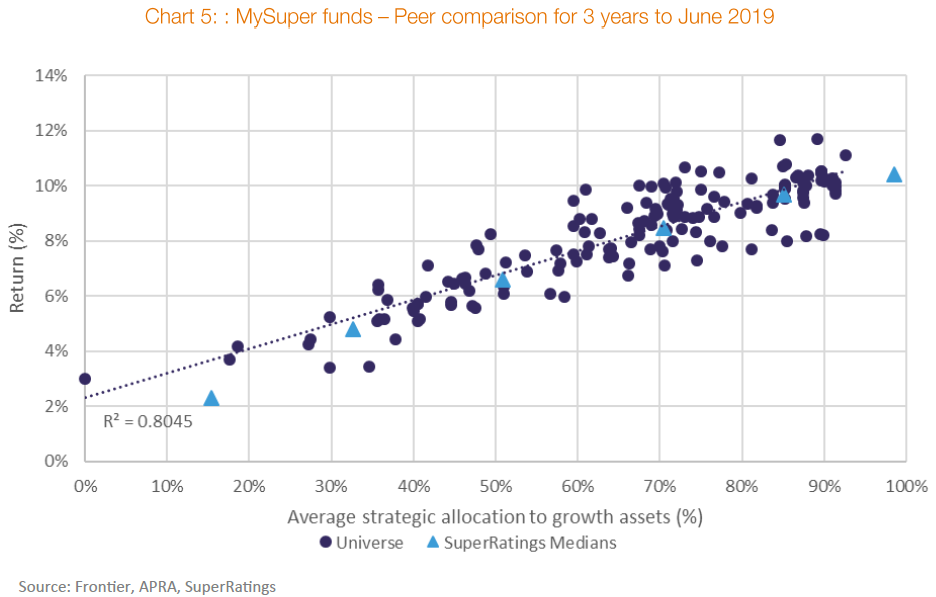

EISS Super was planning a merger with TWUSUPER prior to the performance test results and subsequent revelations about frivolous spending which also saw the departure of EISS Supers chief executive chair and some board members. The assessment under the performance test in conjunction with the ATOs YourSuper comparison tool is intended to hold RSE licensees to account for underperformance through greater transparency and increased consequences. November 1 2021. Ranking super funds based on raw returns gives members no insights on the risks taken to achieve those results making it a flawed judgment mechanism.

Unfortunately a new report by actuarial. Being a trustee of an APRA-regulated super fund and managing and spending billions of. Best super funds for 20212022. SMSFs vs APRA super funds.

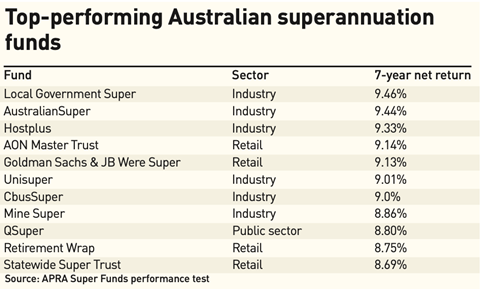

Super funds that are regulated by the Australian Prudential Regulation Authority can be identified by their super fund number. Finance Your Super APRA reveals top-performing super funds over seven years 1000pm Dec 21 2021 Updated. When youre comparing super funds weigh up fund performance and. APRA fails its super performance test.

All Growth category 96100. Super funds with the lowest fees for life and TPD insurance. APRA has assessed 76 MySuper products with at least 5 years of performance history against the. Your employer will give you a standard choice form when you start a new job.

There are 80 MySuper products. Plus the worst super funds to avoid. Our Australian Shares super option ranks 1 on returns over 3 5 7 and 10 years. January 20 2021.

APRA probe into supers in-house switch. Latest super heatmaps highlight best and worst performers. Under the YFYS reforms APRA is required to conduct an annual performance test for MySuper products. Super funds with the lowest fees for.

This page contains the results of. This sets out your options. If your client is an employer with super guarantee obligations a self-managed super fund SMSF or an APRA-regulated fund they will have lodgment obligations. 535pm Dec 21 APRA has revealed Australias top-performing super funds over the past.

Industry regulator APRA published its list of the 13 worst performing super funds back in. A dud super fund typically charges high fees and delivers below-average returns over the long term.

Letter From Australia Super Funds Shame In A Name Features Ipe

Super Fund Performance And Rank Depends On Risk

Apra Forces Underperforming Super Funds To Quit Industry

Posting Komentar untuk "apra super fund performance"